wyoming tax rate sales

The Wyoming WY state sales tax rate is currently 4. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6.

How Do State And Local Sales Taxes Work Tax Policy Center

Lowest sales tax 4 Highest sales.

. Wyomings tax system ranks. Businesses must collect the special excise taxes on top of the sales tax rate of 4 percent. 181 rows 2022 List of Wyoming Local Sales Tax Rates.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. For example lets say that you want to purchase a new car for 30000 you would use. Wyoming Sales Tax Rates 2021.

31 rows Wyoming WY Sales Tax Rates by City. This is the total of state county and city sales tax rates. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of.

Prescription drugs and groceries are exempt from sales. The minimum combined 2022 sales tax rate for Cody Wyoming is. Please note new mailing address as we update.

Groceries and prescription drugs are exempt from the Wyoming sales tax. Address Lookup for Jurisdictions and Sales Tax Rate. Depending on local municipalities the total tax rate can be as high as 6.

Wyoming has a 4 statewide sales tax rate but also has 106 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1436. Sales Use Tax Rate Charts. Tax rate charts are only updated as changes in rates occur.

The base state sales tax rate in Wyoming is 4. The Wyoming sales tax rate is currently. For a more detailed breakdown of rates please refer to our.

The taxes are as follows. Address Lookup for Jurisdictions and Sales Tax Rate. We have tried to include all the cities that come.

The sales tax rate in Powder River County Wyoming is 5. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Beer and malt beverages.

The December 2020 total local sales tax rate was also 6000. Please note new mailing address as we update all the forms. You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04.

Find your Wyoming combined state and. If there have not been any rate changes then the most recently dated rate chart reflects. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

You can find your sales tax rates using the below table please use the search option for faster searching. Address Lookup for Jurisdictions and Sales Tax Rate. The state sales tax rate in.

Maximum Possible Sales Tax. On top of the state sales tax there may be one or more local sales taxes as well as one or. Due to its low sales tax rate and a ceiling of no more than 1 that local governments can add Wyoming was named one of Kiplingers top 10 tax-friendly states for retirees in 2011.

Average Local State Sales Tax. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined. This includes the rates on the state county city and special levels.

The current total local sales tax rate in Wyoming WY is 6000.

Sales Taxes In The United States Wikipedia

What S The Car Sales Tax In Each State Find The Best Car Price

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute

![]()

Wyoming Gasoline And Fuel Taxes For 2022

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

State Sales Taxes Could Cut Into Black Friday Savings Don T Mess With Taxes

Online Sales Tax In 2022 For Ecommerce Businesses By State

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

General Sales Taxes And Gross Receipts Taxes Urban Institute

Wyoming Sales Use And Lodging Tax Revenue Report Campbell County Chamber Of Commerce

Sales Taxes In The United States Wikipedia

5 States Without Sales Tax Thestreet

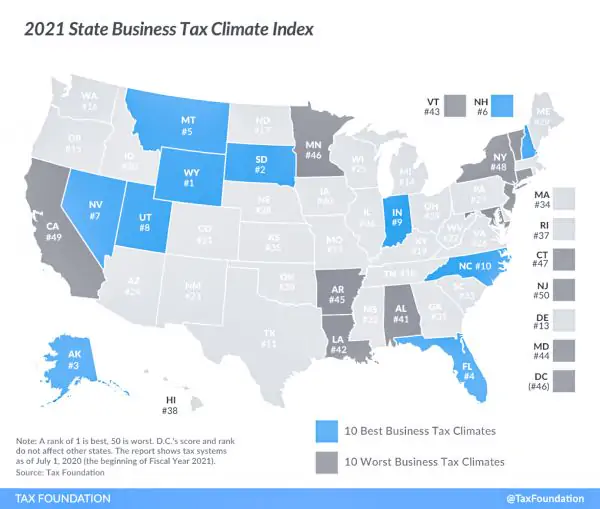

Wyoming Named 1 State For Doing Business Jackson Hole Real Estate Mercedes Huff

State Sales Tax Rates 2022 Avalara

Jackson Hole Real Estate Tax Benefits Buckrail Jackson Hole News

State And Local Sales Tax Deduction Remains But Subject To A New Limit Teal Becker Chiaramonte Certified Public Accountants